March 2019

Uniform Pension Declaration (UPA): correct and timely participant data at lower costs

Higher pension benefits possible due to lower costs of implementing pension scheme.

The UPA is based on the legally required Wage Declaration Chain System (stocks from source systems). As a result, the pension provider receives high-quality pension participant data in a timely and correct manner at low costs.

Cooperation between market parties as the basis for the UPA standard

Accurate and timely collection of participant data is a challenge in the management of pensions. Connecting to the data from the processes and source systems of employers offers the most adequate solution for this challenge.

The Uniform Pension Declaration (UPA) based on the Wage Declaration Chain is often the appropriate means. The UPA periodically supplies a complete database of pension participants from the employer's salary administration – the source system. On the basis of this complete information, the current rights and obligations (entitlements and premiums) can be accurately determined.

Using UPA provides a win-win situation for all parties involved. The pension rights are correct, the pension management costs are reduced, the mandatory pension correspondence can be provided in a timely manner, the administrative burden for employers is reduced and the premium owed can be invoiced at the right time. And in many cases, a higher pension benefit can also be achieved.

Contents

The value of innovation

SIVI develops and manages standards for digital business in the insurance industry. Independent and expert. Based on insights to reduce costs and add value. Insights that go beyond the standards alone. SIVI analyzes trends, investigates the impact of new technologies and inspires all chain partners to take new steps together. With the ambition to make digital traffic work for the sector and the consumer.

SIVI, standard change

Opting for UPA: your considerations3

Annex 1: Developments leading to the UPA6

Appendix 2: A closer look at the UPA9

Why UPA?

Advantages of using the UPA in pension administration are:

The UPA provides high-quality and complete data on the basis of the employer's salary administration, which largely overlaps with the data in the Wage Declaration.

The introduction of the Wage Declaration Chain made a uniform data standard mandatory that all employers had to comply with. This standard was supported by the payroll parties and built into their software. For the realization of the UPA, the Wage Declaration is taken as standard as the starting point. The Wage Declaration data largely overlap with the data required for pension administration. The statement method and periodicity adopted from the Payroll Tax Return Chain guarantee data quality much better than the (mutation) method often used until then. After all, the data “shared” between the standards is filled identically from the source system (the salary administration), while the number of potential plan participants in principle corresponds to the number of employees. Due to the similarities between UPA and the Payroll Tax Return Chain, it can be expected that it will be relatively easy for payroll software developers to connect to UPA.

The UPA provides periodic data in a timely manner , so that the pension premium is collected and invested at the right time. Advance bills and subsequent calculations are no longer necessary.

Through better data quality, the UPA reduces administration costs and improves pension administration.

Because the UPA provides complete participant overviews, this enforcement aspect of participant control is in principle superfluous. 2

Enforcement , determining that the participant data received is complete and correct, is essential in connection with the correct collection of contributions and accrual of pension rights. The sending of mandatory participant correspondence also partly depends on the timely availability of participant data. Conducting a pension administration on the basis of changes to be passed on by the employer is laborious, determining the correctness and completeness is a challenge and inaccuracies in the data affect a multitude of follow-up processes and the rights administration .

For the employer, passing on participant changes is an administrative burden that does not add any value. In practice, this poses a risk to the quality and timeliness of those changes. Timeliness and quality are essential for the pension administration organisation.

Working with complete participant tiers makes checking for completeness and correctness much easier by allowing comparisons with previously reported tiers. For the employer, however, passing on complete participant files is an even greater administrative burden than only passing on a few mutations. This will change when the employers' salary software offers provisions for this, such as the UPA.

Salary software developers can calculate the pension premium correctly with the help of the UPA. The UPA is already built into most payroll software.

The UPA contains data sets necessary for the administration of virtually all pension plans.

Using the UPA makes it easier to switch to other schemes or implementing organisations.

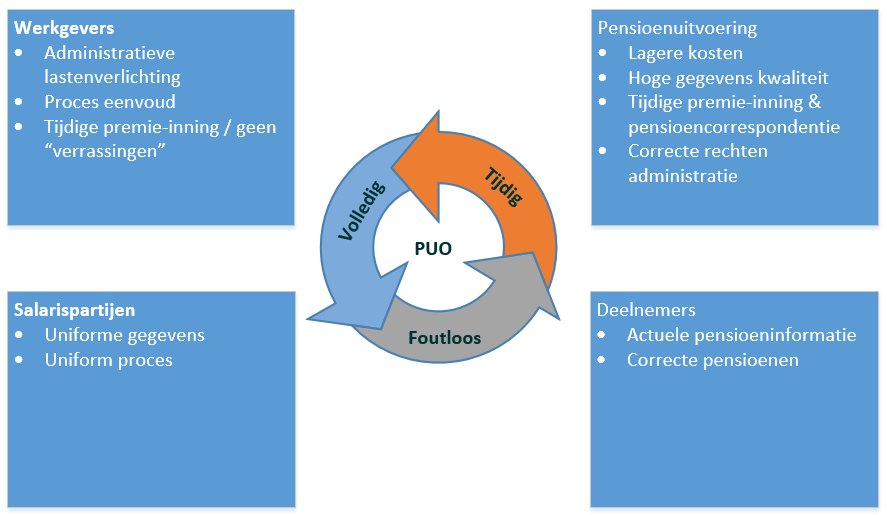

The following benefits can be identified for all parties involved in the pension chain (Figure 5):

Figure 1 : Benefits of applying UPA in the chain

Opting for UPA: your considerations

Switching to the UPA means an investment in administration systems and processes. A thorough preliminary investigation of the consequences for your administration and weighing up the implementation alternatives is therefore of great importance.

The UPA works on the basis of positions. You can also consider switching to a fully stand-oriented administration within your organization. This will lead to a completely different investment size and lead time than maintaining the internal mutation-oriented method, which is fed with participant mutations derived from UPA files. A strong or less strong degree of interdependence between the different parts of your administration system also influences the necessary investments and the lead times.

An alternative to the UPA

An alternative to the UPA data set is the Wage Declaration data set from the UWV Policy Administration. In practice, performing the pension administration on the basis of only the “Wage declaration” data from the UWV Policy Administration is not possible for many existing pension schemes. There is a mismatch between the data in the Policy Administration and the data necessary for the administration of many pension schemes 3 .

At the start of 2019, the UPA will be used by pension administration organizations AGH, AZL, Nationale-Nederlanden, PGB, PGGM and Provisum. Achmea, TKP and Centric are making preparations for a switch to UPA.

Implementation of the UPA

In order to implement the UPA successfully, the pension administration organization will have to take into account internal and external stakeholders in the chain.

Internal development

Implementation of the UPA means an ICT project/program with many and very different focus areas:

The ability to receive UPA data must be arranged. This includes making web services available and making options available for exchanging data via the file transfer protocol (FTP).

Validate / check UPA.

Process data in the pension administration(s), whether or not position-oriented.

It is important for both the pension administration organization and the supplying parties that delivery can be tested in a specific test environment.

Drawing up scheme overviews and opening up the calculation rules.

External tuning

Using the UPA is a form of chain collaboration. Coordination with the other chain parties is therefore necessary.

Approach salary software developers and make agreements with them about, among other things, when you switch to the UPA, make documentation, test sets and premium calculation examples available to the salary software developers.

Make reference visits to pension administration organizations that already use the UPA.

To test

Testing the program is important. SIVI makes a generic test set available. All regular participant events are included in this test set so that the salary software developers can assume, after successful execution of these tests with the data from the relevant pension scheme, that the data processing will run smoothly.

Conclusion

The Uniform Pension Declaration is a data and agreement standard based on the Wage Declaration for the periodic exchange of pension participant data between employers and pension funds/pension administration organisations.

The use of UPA offers benefits for all parties involved. The pension rights are correct, the pension management costs are reduced (and can therefore even lead to higher pension results), the mandatory pension correspondence can be provided in a timely manner, the administrative burden for employers is reduced and the premium owed can be invoiced at the right time. In short, by using the UPA, data collection for the benefit of the pension administration is greatly improved.

The quality of the data is guaranteed because it comes from the employer's payroll administration, which also produces the legally required Wage Declaration data. The UPA data set is largely identical to that of the Wage Declaration. Partly for this reason, it can be expected that it will be relatively easy for payroll software developers to connect to UPA.

UPA simplifies the pension declaration process for employers. In addition, premium surprises (annual supplementary payments) are a thing of the past.

The UPA serves the interests of several parties in the pension chain. Procedures have been drawn up and consultation structures have been set up to ensure coordination of those interests.

Appendix 1: Developments leading to the UPA

The UPA standard is the logical consequence of several developments. Developments at the tax authorities, concentration of pension administration and increasing use of salary software by employers.

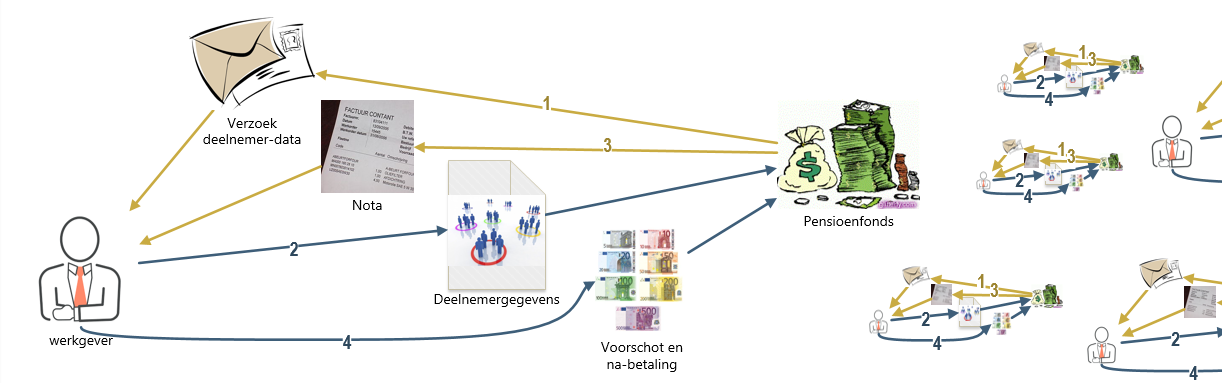

In the past, pension changes between employers and pension funds were exchanged on the basis of bilateral agreements between these parties (see figure 1). Each of those agreed sets of data covered a specific pension scheme / pension provider.

Figure 2 mutation-based data exchange / many specific data sets

A request from the fund to pass on participant changes (1) was followed, sometimes after a long wait, by supplying those data (2) by the employer. Data that, after possible corrections, lead to advance bills (3) and an annual bill at the end of the year in which all remaining amounts were settled.

As long as only the employer and the pension fund were involved in this data exchange, this was a well-functioning solution. However, pension schemes are changing and there is also a strong concentration trend in the pension chain, as a result of which the data set to be supplied often changed even when transferring to a (different) pension administration organisation.

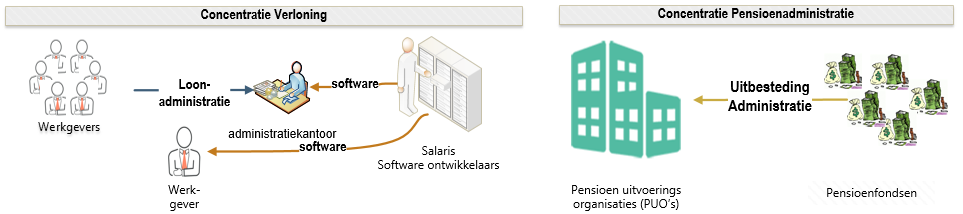

Figure 3 : Outsourcing and specialization

To save time and money, employers are turning to outsourcing the increasingly complex payroll administration. Employers and administrative offices are increasingly using payroll software from specialized parties. With the help of the salary software, the pension participant data can be created directly from the source system, the salary administration.

A similar trend is visible in pension funds; more and more pension funds are moving to have their administration carried out by a pension administration organization (see figure 2). Where possible, participant mutations are increasingly derived from source systems such as those of the Personal Records Database (BRP, formerly GBA).

The government's pursuit of administrative burden reduction in the 2000s resulted in the Whale Act 1 which led to the creation of the Wage Declaration Chain 4 .

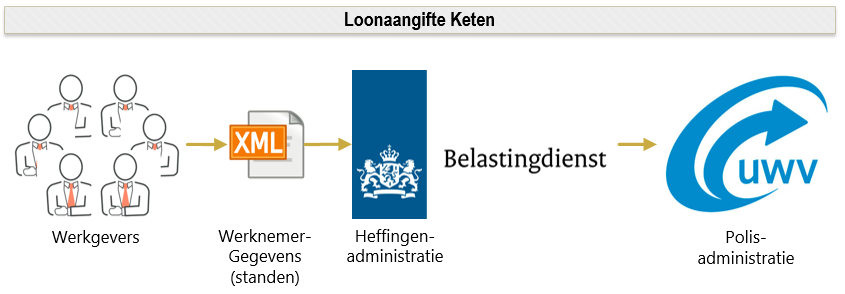

Figure 4 Wage declaration Chain / Delivery positions mandatory

Since 2006, employers have been legally obliged to file a wage declaration for each employee in XML format. A Wage declaration contains all data, the status, of all employees that form the basis for the payroll tax for the relevant period. The data is recorded in the Tax Administration's Tax Administration and the Policy Administration of the UWV (see figure 3).

The data from the Policy Administration is made available to customers by the UWV 5 . Pension funds can also purchase this data.

The realized Wage Declaration XML standard (LA) contains a lot of data that is also important for pension administration and is the basis for what ultimately became the UPA. These developments lead to the situation outlined in figure 4

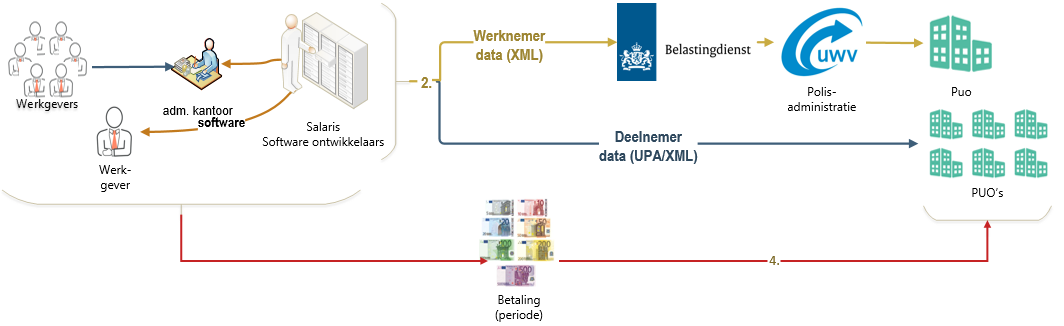

Figure 5 standardized – chain – data exchange

The request for participant mutation s (Figure 1) is no longer necessary.

During the periodic salary run, both the position data (2) for the Wage Declaration and those for the UPA are created. The UPA contains the Wage Declaration data relevant to pension participation and additional data that are necessary for most pension schemes.

A single pension scheme can be implemented on the basis of the data set available in the UWV Policy Administration. Due to the topicality and quality of the (stand) data, advance bills and annual final settlement are no longer necessary. Amounts due over a period will be charged and paid (4) immediately after the period over which they are due.

Appendix 2: A closer look at the UPA

The Uniform Pension Declaration is a data and agreement standard based on the Wage Declaration for the periodic exchange of pension participant data between employers and pension administration organisations.

Dataset

The UPA data set contains the data elements 6 necessary for all participating pension administration organizations for the pension schemes to be administered by them:

Pension-relevant data of employees/participants supplemented with a number of pension-specific data such as pensionable salary, contribution base, scheme salary and scheme reference.

Pension-relevant calculated (scheme premium) data and their totals.

Message-identifying data (origin, destination, employer, time period and the like).

Compared to the Wage Declaration Message, the UPA contains about 50 additional data elements. These additional data (see Appendix 3: UPA specific data) are required, among other things, to identify the pension fund and the relevant pension scheme, but also to be able to correctly determine the calculation of the entitlements and pension contributions. The data elements taken from the Wage Declaration Message have been kept the same, partly in order to maintain comparability with the Tax Authorities and the UWV Policy Administration.

The UPA dataset contains the “stand” , which means that the dataset contains all UPA data of all employees of an employer at the end of a period. The use of positions eliminates the need to explicitly report every participant change (such as employment and salary adjustment) in all details. Events (mutations) can be derived from the difference between the positions of two consecutive periods. Based on, for example, a changed salary or a new participant in the list.

Scheme overview

The scheme overview is published as part of the UPA. It unambiguously publishes the “constants 7 ” for all schemes that are important for configuring the pension scheme in the payroll administration.

These constants are used in combination with the UPA data, among other things, when determining the pension premium by the salary software 2 .

Data exchange

UPA files are made available to the pension administration organizations from the salary administration via file transfer or web service, with the same periodicity as the Wage Declaration, in the form of an XML file. The pension administration organizations check these files. The receiving pension administration organization feeds back the result via the same communication channel; file transfer or web service.

Test facilities

SIVI makes a (generic) test set available to support the development and implementation of the UPA. In addition, the pension administration organizations offer support through test services for new implementations and periodic releases.

Management

The UPA was realized under the auspices of the Pension Federation and is managed on behalf of the Pension Federation by the SIVI foundation. The management has a governance structure in which, among others, pension administration organizations and salary software developers participate. The ultimate decision-making authority rests with the “Digital Standardization & Development (DSO)” steering group. Management focuses on necessary and/or necessary changes to the standard and the associated documentation so that the UPA remains a widely supported standard. The release calendar of the UPA runs along with the release calendar of the Wage Declaration (one release per year). The costs of managing the UPA are borne by the pension administration organizations from the DSO steering group.

The documentation is accessible at www.sivi.org . Questions about the UPA can be directed to UPA@sivi.org .

Appendix 3: UPA specific data

UPA data NOT in Wage declaration |

Number of the supplier (contributor). |

Name of the supplier (contributor) |

Periodicity of the employer's tax return period. |

(relationship) Number under which the employer is known to the PUO. |

Control feature. |

Regulation variant |

Total amount of pensionable salary |

Total amount of premium base |

Total amount of premium |

Total number of paid hours |

Number of Income Relationships |

Balance of premium due to corrections |

Reason for end of income relationship (including death, dismissal, incapacity for work) |

Date of death |

Marital status |

Marital status date |

reason for exemption from participation |

Employee email address |

bank account employee |

partner name |

partner prefix |

partner initials |

partner gender |

nature of employment relationship |

type of profession |

job description employee |

Hours standard per week |

Hours according to contract |

Parttime percentage |

Specification of income ratio, e.g. reintegration or functional age dismissal |

Indication of whether or not wages count towards the scheme. |

Gross hourly wage |

Pay in cash |

Gross commission counting towards pension |

Irregularity allowance that is taken into account for pension |

The gross daily wage |

number of days of daily wage in period |

type of leave taken into account for the pension scheme |

Number of hours of unpaid leave taken into account for this period. |

Percentage of leave in relation to the number of contract hours. |

Date from which the participant participates in the scheme |

Date until which the employee participates in the scheme within the period. |

The part of the gross salary that counts for the pension accrual |

The (calculated) premium base determined in accordance with the scheme. |

The (total) calculated premium for this scheme. |

The premium calculated for the employee for this scheme. |

Number of hours paid for the employee |

Further information can be found in the “ UPA Product Description ” which can be downloaded from www.sivi.org .

Footnotes:

Some pension schemes can even be fully implemented on the basis of this data (see also our paper on the UWV link).

According to the UPA product description, the employer provides, as it were, a photo of the remuneration paid for its employees. This means that no employees/participants should be missing.

For more information about this “UWV route” see our paper: “UWV link offers the opportunity for far-reaching cost reduction in pension portfolio management ”.

Administrative Burden Reduction and Simplification Act Act of 24 June 2004, Staatsblad 2004, 31”

Companies or (semi-) government organizations including pension providers.

The UPA contains approximately 100 data elements, about 50 of which are not included in the payroll tax return. Of

With these data elements, the information needs of the vast majority of pension schemes in the Netherlands are covered.

In this context, constants are data that are adjusted annually (for example, a franchise, premium percentage and various maximums) or when a pension scheme is changed.

Key data used for this are: pension fund, scheme and the scheme variant.

1 » 12